Philippines – The pandemic flipped everything on 360 degrees, and to look at the current rankings of the top companies in the business sector is to view it from a whole new perspective. Market research firm Euromonitor International has recently released its list of the top companies in the retail industry in Asia for 2020, and in the Philippines, a majority of those that were leading the in the year 2019 are still the ones that reigned in 2020.

Out of the 10 in the list, the top five all registered steady growth in sales in 2020, retaining their standings from the past year. SM Retail, which holds a nationwide portfolio of department stores, supermarkets, and specialty stores, still came out as the leading firm in the sector. It was followed by pharmaceutical company Mercury Drug, with grocery retailer Puregold Price Club coming out on the third spot. Meanwhile, another giant in retail, Robinsons Retail Holdings, registered neither a drop nor an improvement in sales as well, landing the top fourth spot, while specialty store group Seven & I Holdings rounded the top five.

Three of the top firms, which are also all international companies – beauty and wellness AS Watson Group, China-based Alibaba Group, and Shopee’s parent company Sea – all recorded improvements in sales landing the 6th, 8th, and 9th spots respectively.

Meanwhile, local grocery retailer Metro Retail Stores Group was shown to drop sales in 2020, with international home retail Wilcon Depot also demonstrating the same movement in sales.

SM Retail, which registered $5.4b in sales in 2020 came out as the 9th leading retailer in the Southeast Asia region. For the region, Tokopedia took the crown with $11.7b in total sales for the year.

Meanwhile, for the whole of Asia, it was China’s Alibaba Group Holding and JD.com that were named as top firms.

The pandemic remains to be the biggest determinant of the rankings, where the lockdown in the Philippines had become one of the longest globally, which started in March of 2020, and is still presently in reinforcement. According to Euromonitor, this affected the way people chose to fulfill their essentials, where mixed retailers were the worst hit, with consumers opting for specialist retailers, presenting a convenient way to obtain what they needed in stock.

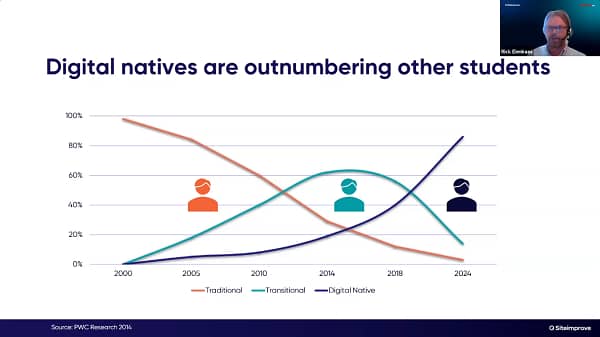

With people cooped up at home, the current situation panned out greatly for e-commerce, and this showed with Shopee’s parent firm Sea registering an increase in sales. According to the report, the category had already been growing at a double-digit pace pre-lockdown but this was accelerated in 2020 with people maximizing the ease of online retail.

An interesting growing trend in 2020 in the Philippines is community stores, or stores that are situated in nearby communities and neighborhoods. These existed prior to COVID-19, and the increase in popularity can be attributed to the presence of Alfamart, a minimart that is a hybrid between a supermarket and a convenience store.

Alfamart is a chain of convenience stores from Indonesia, with over 10,000 stores across Indonesia and the Philippines. Euromonitor said the concept increased in relevance in 2020 as consumers looked for the most convenient ways to complete their shopping trips, with the trend expected to continue further.