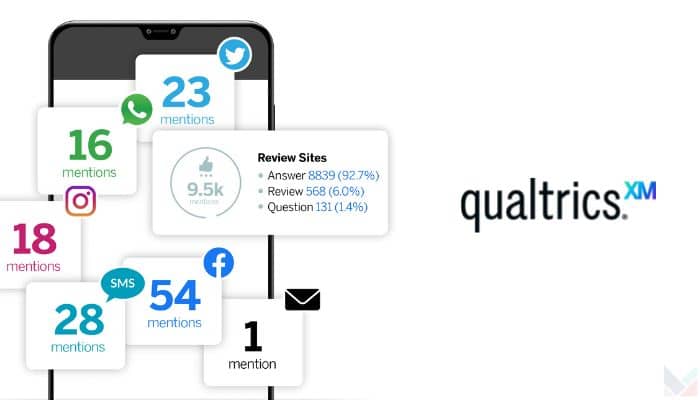

Singapore – Super apps – mobile applications that can offer multiple services within a single app – are here to stay, with around 51% of Singaporeans reported to have used them at least a couple of times every week. This is according to the latest data from Qualtrics, with support from SAP and Center for Experience Management in Singapore.

According to the data, the most frequent use cases are shopping for general items, buying groceries, ordering food and ride-hail services, paying for items in-store, and arranging for items to be delivered.

In terms of which super app features are mostly used, digital wallets come out on top. Around 59% of respondents said they have used a digital wallet to make a physical purchase in the last 12 months, and 64% said they intend to use a super app to make a physical purchase in the next six months.

Meanwhile, it is also revealed that consumers have less intent to use a super app for listening to music, messaging friends, playing games, and buying insurance.

When it comes to factors that would increase super app usage, feedback suggests overcoming consumers’ concerns with privacy and security is one of the main areas to address. The study also revealed that consumers are looking for improvements in mobile app ease of use and payment options, across many of the brands and apps that they interact with.

“Equipped with the right customer insights, brands can tailor how they deliver services via super apps to ensure this new channel complements their customer experience for the people that are using them, while maximising the investments they’re making in the space. And simultaneously, by knowing what customers aren’t using super apps, organisations can take important action to ensure no-one is left behind by the change underway,” the research noted.