Singapore – Around 3 out of 4 Singaporeans have said that they are now more confident in recognising scam calls and SMS than they were 12 months ago. This is according to the latest data from cloud communications and customer experience (CX) software company Toku.

An overwhelming 91% of respondents believe that organisations are making an effort to educate the public about scams, empowering them with the knowledge to identify and thwart scams effectively.

An example of a government initiative that made a noticeable impact is the SMS Sender ID Registry (SSIR). In early 2023, the SSIR made it mandatory for organisations to register their brand names with the Infocomm Development Authority of Singapore to verify their identity when they use SMS.

According to data, 87% of Singapore consumers said the SSIR has made it easier to identify the legitimacy of the SMS they receive. 63% also noted that the SSIR has resulted in them receiving less spam or scam messages.

Thomas Laboulle, founder and CEO at Toku, said, “Over the past 12 months, consumers in Singapore have shown a clear shift in their awareness of scams and a rise in their confidence in dealing with them. his has had an impact on the levels of trust they have for the communication channels they use, leading to changing preferences and behaviour in how they interact with brands.”

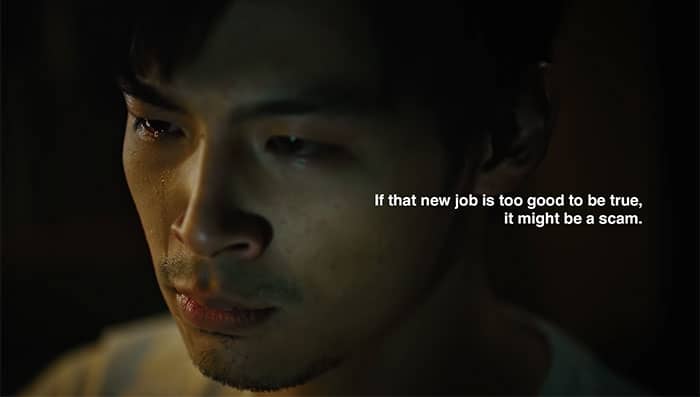

Despite scam SMS still being prevalent, around 73% remarked that they are more confident in recognising them. Less than a quarter of consumers clicked on URLs in these messages over the past 12 months, and only 13% encountered monetary loss as a result.

The same confidence is also reflected when it comes to scam calls. Around 75% expressed confidence in their ability to identify scam calls, and the number of consumers who picked up a scam call in the past 12 months fell by 19%.

Despite being digital natives, more than a third (36%) of millennials willingly click on suspicious SMS links even if they’re marked “Likely-SCAM” – the highest proportion amongst all the age groups. In contrast, only 8% of those aged 18-24 and 13% of those aged 45-54 are likely to click on these suspicious SMS links.

Labouelle added, “This result may be surprising, but it’s in fact in line with numbers from the Singapore Police Force. Data released by the police in September 2023 showed that those aged 20 to 39 were the most likely to be cheated in scams, making up more than 50% of all victims.”

The data also uncovered how many Singaporean consumers have clear preferred channels for communication from brands. For instance, SMS remains highly preferred by Singapore consumers for OTPs (79%), bank alerts (76%), and appointment reminders (72%). At the same time, WhatsApp gained popularity for marketing messages (47%) and order updates (55%).

Meanwhile, approximately 3 in 4 consumers are inclined to contact an agent over the phone when confronted with urgent matters pertaining to payment or finance. Similarly, 2 in 3 will reach out to a phone support agent to resolve issues associated with products and service faults.

“Our research shows that Singapore consumers have varying levels of trust and preferences for different channels and types of communication. Organisations should pay attention to these preferences to meet customers where they want,” Laboulle said.

He added, “The rise of generative AI gives companies an unprecedented opportunity to reinforce consumer trust and build more personalised customer experience. AI can take over repetitive and tedious tasks while empowering human agents with the right information and context to further improve their customer service.”