Singapore – Revolut, a global fintech company, has launched a debit card vending machine at the National University of Singapore (NUS).

In partnership with Visa, Revolut’s initiative aims to provide students with access to financial services. Since some students below the age of 21 may not have access to traditional banks, Revolut can provide them with debit cards and access to money management tools.

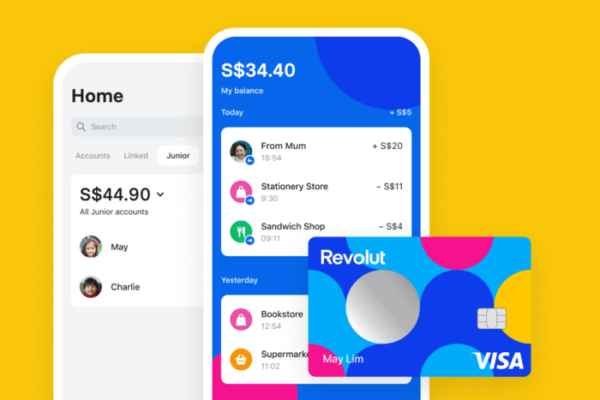

The Revolut cards enable students to send and receive money locally and internationally, use budgeting and analytics features, and enjoy incentives such as cashback. It also allows them to start their investments.

Revolut also offers a group bills feature, which allows students travelling in groups to settle payments regardless of the currency in the app. The app also allows users to store up to 34 currencies and spend in more than 150 currencies worldwide.

Additionally, students can use a virtual card and add it to their e-wallet, enabling them to use it in both physical and online stores.

Raymond Ng, chief executive officer at Revolut Singapore, said, “We are always looking for new and innovative ways to make money management accessible to our customers. We are really excited to launch Singapore’s first-ever debit card vending machine in one of the most established and largest universities here, making it easy for students to get their cards. Whether it’s spending in 150+ countries around the world, splitting bills seamlessly with friends, saving for a new Playstation or learning about various investing tools, Revolut will be their all-in-one money companion.”

“At Visa, we believe in the power of collaboration and innovation. Working with valued partners like Revolut, who are at the forefront of creating innovative products tailored for the Gen Z segment, is crucial. These products not only help young people manage their money effectively but also educate them about investments, supporting their financial journey,” Adeline Kim, Visa country manager for Singapore & Brunei, said.

“Based on our Gen Z research, close to 40% of Gen Z consumers indicate that convenience is a crucial factor in determining which product they use to pay, and the same number highlighted better rewards and offers would make them switch to alternative payment methods. By providing easy access for the youths to obtain their debit cards through the vending machines at NUS and providing great cashback when they shop and pay, we help to support this next generation to take control of their financial future,” Kim added.