Digital applications have been a key enabler in creating a connected digital life for consumers. With the COVID-19 pandemic accelerating the adoption of digital applications and placing more focus on online shopping channels and digital payments, holiday shopping and Christmas rush might be a little different this year. As the holiday season approaches, we are seeing a fundamental shift in social interactions, digital entertainment and shopping habits.

Online shopping continues to grow year-over-year. In 2019, Forrester estimates that 56 percent of shoppers in Southeast Asia (SEA) will make their purchases online.

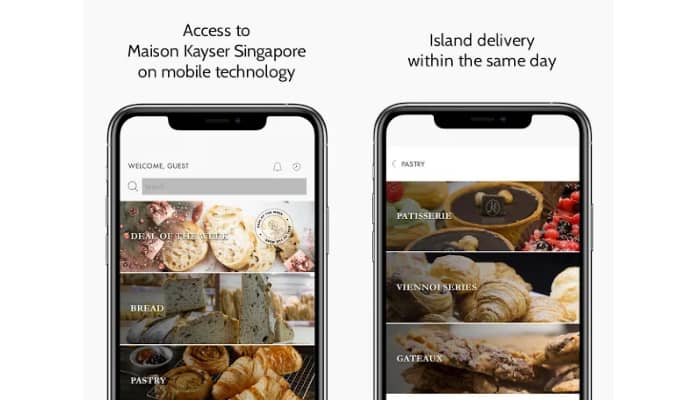

With mobile as the main channel used by shoppers, the same study predicts that 62 percent of online retail sales in SEA will come from mobile purchases. This presents opportunities for brands to reach more than 150 million online shoppers from various markets across the region including Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

Online shopping statistics

When developing a marketing strategy for Christmas, it’s essential to check online Christmas shopping statistics and know how this will impact your overall strategy. For instance, due to the pandemic, the latest Retail Sales Index and Food & Beverage Index from the Department of Statistics in Singapore shows a – 5.7 percent decline on total retail sales compared to last year. However, items under Recreational Goods, Furniture and Household and Computer and Telecommunications category have a positive increase in sales this year.

Digital payments for frictionless shopping

Online shopping is also gaining momentum in the region due to the rise of digital payments. According to Deloitte’s report, Indonesians and Singaporeans are amongst the highest proportions of people who shopped online and retail shops that prefer digital payments. Digital payments are fast and frictionless. As more merchants adopt digital payment channels, e-commerce apps must also ensure that they leverage digital payment channels to respond to the demands of the consumers.

Here are some of the best practices to keep in mind when developing your e-commerce marketing campaign for the holiday season.

1. Free shipping

Adding unexpected costs at the final stages of the user journey may frustrate your customers and cause them to churn. This is why free shipping may be worth the expense. Entitling your users to free shipping during the holiday season is an effective gift to shoppers, and may give you the edge over your competitors.

2. Bundles and gift guides

Creating bundle offers is an effective way to autonomously upsell to your customers while also giving them a good deal on grouped purchases. Bundles are also a smart way to turn inexpensive items into a more significant gift recommendation for your users. Alternatively, you can include a ‘recently bought with’ function on your website or app to encourage multi-item sales.

You can also create curated gift guides to help shoppers with their search, combining best-selling items, surplus stock and discounted items.

3. Offer gift cards

Gift cards are a simple but effective way to generate revenue during the holiday season. For best results, gift cards should be purchasable and can be used digitally and in-store. This accounts for the preferences of all gift-givers and those who have received your gift vouchers.

4. Set up a themed landing page

Get your shoppers into the Christmas spirit by directing them to a Christmas-themed landing page – where you can share your curated gift guides and bundle options, and encourage customers to proceed with their purchases.

5. Branded hashtags

Using a branded, Christmas-themed hashtag across your social media channels is a smart way to raise brand awareness while also providing app users with a means to share their purchases on social media. Examples of Christmas-themed hashtags by brands include #SwishUponAStar (Lush cosmetics) and #BarbourChristmas (Barbour).

This also allows your social media team to gather user-generated content (USG), which can then be shared and retweeted.

From a retailer’s point of view, Christmas is the most wonderful time of the year. Despite the challenges of the year, the Christmas season is a great opportunity for e-commerce app marketers to boost sales, build their audience and reward loyal customers.

The author is April Tayson, Vice President for Adjust India and Southeast Asia. Adjust is an app marketing analysis platform, and provides services such as attribution and measurement, fraud prevention, cybersecurity, as well as automation tools for mobile apps.

If you want to be part of MARKETECH Experts Group, please click here.