Singapore – Asian smart living management system Habitap announced a strategic partnership with real estate company JLL to curate a super-app that provides a smart building experience with a range of smart functionalities for JLL’s clients.

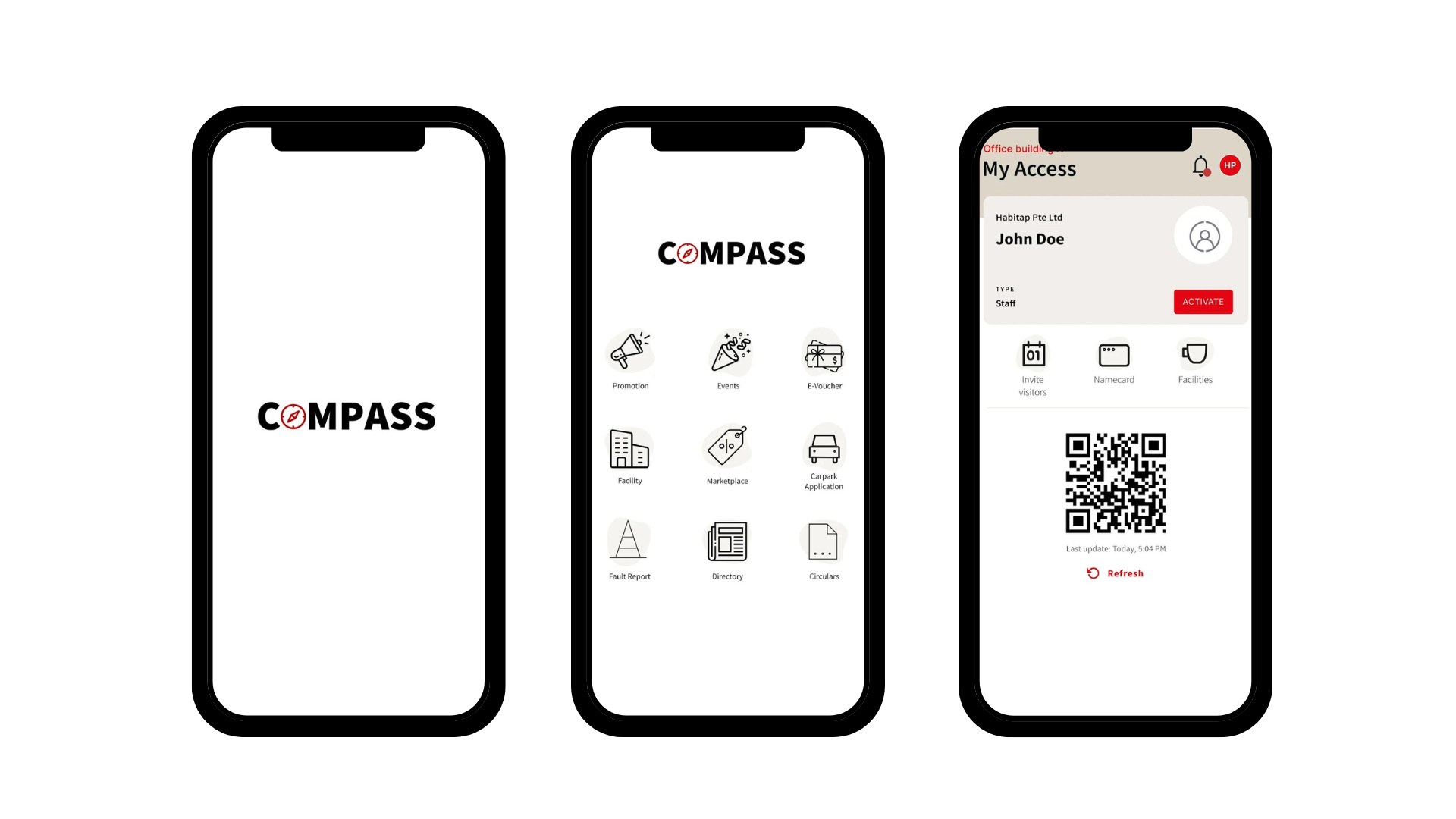

Powered by Habitap, the super app called ‘COMPASS SG’ allows JLL clients access to a wide range of control and management over their smart households, as well as avail other features such as security and building services.

The COMPASS SG app is fully customisable based on each clients’ individual needs, allowing for a fully integrated, connected tenant experience programme that combines technology, tenant experience and community features. In addition, this app includes a real-time access control management portal that allows tenants to track important building information.

Various visitor access options are also available to allow tenants to manage their visitors more efficiently. For example, they can register through facial recognition, HID Mobile Access or a QR code sent to them before their visit and or via a kiosk powered by Habitap. Other features include wayfinding, electronic lockers, and car park management tools.

The app further provides access to real-time data, giving greater security and control over their facilities. Tenants can also apply for building and maintenance services as well as send circulars, push notifications, and emergency broadcasts. Furthermore, the smart concierge feature, facility booking, and Building Management System integration feature automates administrative tasks for the clients so that they can focus on running their businesses.

Additionally, the community functions of the app enable tenants to easily offer promotions and news to their customers, as well as a more efficient way for users to sign up for upcoming events and redemption of vouchers, allowing for better capability to drive promotions and to engage the community.

Commenting on the partnership, Franklin Tang, founder and CEO of Habitap, said, “We are thrilled to partner with JLL – a trusted global name in the commercial real estate industry. Habitap’s goal has always been focused on helping organizations transform through vision and technology to ultimately enable people to experience a Smart Living lifestyle.”

Meanwhile, Derek Soh, executive director of JLL, said, “We are excited to be working with Habitap, whose commitment to delivering experiential real estate solutions mirrors our own. Our partnership with Habitap is a testament to our dedication to providing the best-in-class, innovative solutions that drive our clients’ experiences to the next level.”

As part of the partnership, JLL has already rolled out the app in one commercial building in Singapore and will progressively implement it in more buildings by the fourth quarter of 2023.