Manila, Philippines — A new digital campaign entitled ‘Future Farms’ has been recently launched by the Department of Tourism (DOT). The campaign intends to promote farm tourism, one of the sector’s promising gems, and to offer pandemic-weary travellers a refreshing environment and new experiences. The Future Farms video series can be viewed on the ‘Tourism Philippines’ YouTube channel.

The Farm Tourism video series has featured must-see farms possessing unique characteristics of the touted ‘’future farm” — innovative, scenic, product-centric, and machine-oriented.

‘Future Farms’ is the fruit of the government agency’s efforts to redevelop tourism products and seek out new types of destinations and activities for travellers in the new normal. This innovation allows farm owners to maximise the potential of their property, employ more people, and give tourists more destinations to discover and agri-tourism products to enjoy.

The farms to be featured are located all over the Philippines and include sites such as Diaspora Farm and Resort in Bacolor, Pampanga, Amancio Nicolas Agri-Tourism Academy in Cordon, Isabela, Yamang Bukid in Puerto Princesa City, Palawan, Orchard Valley Farm in Pavia, Iloilo, among others.

Since 2018, the DOT has been strengthening the development and promotion of farm tourism as a major tourism product. It supports stakeholders in innovating and diversifying farm sites around the country to include recreational and leisure activities for tourists in addition to food and wellness.

The DOT said its farm tourism campaign ‘will definitely awaken the farmer in you as you explore the unique and fascinating farms in the country.’

Those interested in the project can visit DOT’s dedicated website for more information on DOT’s Farm Tourism partner destinations.

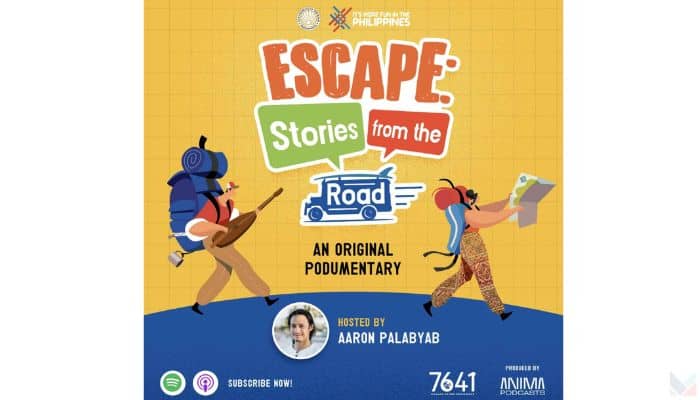

‘Future Farms’ is one of DOT’s original initiatives for tourism in the past month. Other notable projects include the inclusion and consideration of women and PWDs in the tourism industry, and a new ‘podumentary’ on the different rich cultures and traditions the Philippines offers, entitled ‘Escape: Stories from the Road’.