Kuala Lumpur, Malaysia ー United Overseas Bank (UOB) Malaysia has launched Mighty Insights, a mobile banking app based on artificial intelligence (AI)ーa first in the countryーto create simpler banking transactions for customers of the said bank.

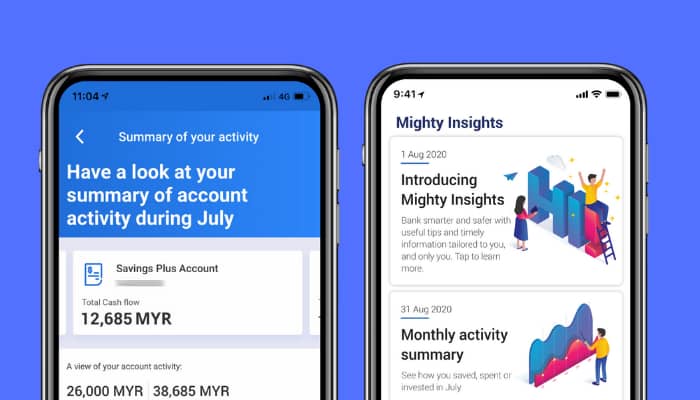

Said app features a dashboard for the customer’s monthly expenses based on their credit card spending, app alerts for third-party subscriptions, merchant payments, or insufficient balance. A Quick Response (QR) code payment function has been also added to the app to ensure safer fund transfers or payments.

The app also features advanced data analytics, machine learning, and pattern recognition algorithms to help customers provide financial guidance in terms of spending, life age, and lifestyle priority variances.

Driven with the same analytics as UOB’s AI-driven predictive analytics engine and TMRW, a mobile-only bank designed for ASEAN millennials, Mighty Insights is second in the line which launched AI-driven mobile banking.

Ronnie Lim, managing director and country head of personal financial services for UOB Malaysia, expressed that the recent mobile banking app launch is just one of the bank’s strategies to further harness the technological capabilities for banking and finance for customer-centric experience.

“As technology continues to improve the way we manage our finances, we designed Mighty Insights to anticipate our customers’ banking needs and to offer them the most suitable financial solutions to help them save and spend wisely. Each insight is personalised based on the customer’s spending habits and banking behaviour. Driven by AI and machine learning, Mighty Insights enables customers to track their day-to-day spending conveniently and to view easily the categories they have been spending on the most,” Lim stated.

The app is available for download at the Google Play Store, the Apple App Store, or at Huawei AppGallery.