Singapore – Snigdha Nandan, most recently the director of B2C and digital marketing for APAC at Mastercard, has taken a new role as the executive director and global head of digital marketing at Standard Chartered. In a conversation with MARKETECH APAC, Snigdha mentioned that she will lead all digital marketing initiatives for the brand’s top markets in the Wealth and Retail Banking (WRB) space.

“This includes driving global marketing campaigns at scale, optimising performance marketing efforts for our key consumer segments and driving a digital transformation initiative that enables us to champion personalised marketing campaigns across the consumer lifecycle. I also lead marketing analytics and effectiveness in my role,” she explained.

In her recent role at Mastercard, she played a pivotal role in shaping brand marketing, paid media, performance marketing, and social media strategy across Asia-Pacific. She spearheaded strategic B2C marketing programs to expand consumer engagement in key passion areas such as travel, culinary, sports, music, and gaming.

Moreover, she also played a key role in the global launch of Mastercard Gamer Xchange and introduced AI/ML-powered solutions like the Digital Engine in Asia.

Prior to Mastercard, Snigdha spent 10 years with PayPal, and held several key leadership roles across consumer and B2B marketing, driving strategic initiatives in international and regional markets. Moreover, her expertise in strategic partnerships, performance marketing, and cross-border commerce played a crucial role in strengthening PayPal’s market presence across diverse regions in APAC.

Speaking on how her past experiences will play out in her new role at Standard Chartered, Snigdha said, “With my almost 14 years of marketing experience in the fintech and payments space, I have a lot of learnings to take to my new role at Standard Chartered. I have worked across different players in the financial services ecosystem now–from a wallet, to a card network to now an issuer/bank.”

She added, “These organisations often work in partnership to meet a consumer’s financial needs. For example, the affluent customer segment has been a common one across various roles and I have seen these segments’ digital behaviours over the years. That, in my opinion, is definitely an advantage. I also carry my 14 years of experience in digital marketing to drive excellence as a subject matter expert.”

She joins Standard Chartered ahead of the rollout of the brand’s ‘Now’s your time for wealth’ campaign, which she was a part of. The campaign, done in collaboration with Publicis Groupe Hong Kong and Singapore, delivers a compelling message: “The cost of waiting could mean falling short of one’s wealth ambitions.”

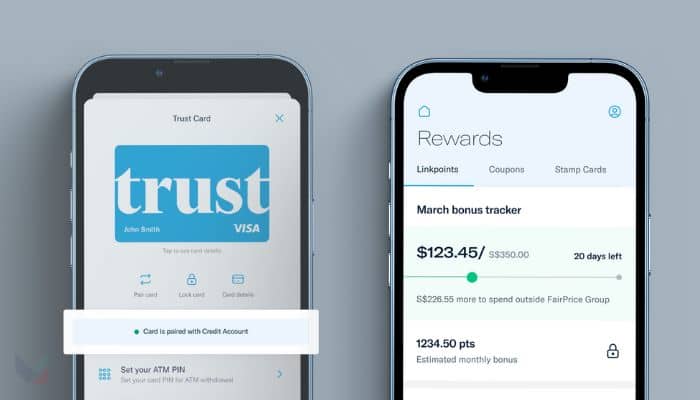

When asked about what lies ahead for her role at Standard Chartered, she stated, “One month into my role, I am amazed to see the innovation that is happening in the bank and in the financial services space. The way Standard Chartered is innovating with its products to provide more tailored solutions, creating seamless onboarding journeys for customers, driving personalisation across channels, and quickly adopting tools and technology backed by AI to drive this personalisation is impressive.”

She added, “The Digital Transformation initiative that I will lead will be another step in future-proofing our marketing campaigns. There’s a lot more to come.”