Australia – News Corp Australia’s digital marketing service News Xtend has struck a partnership with Singapore’s news and publishing company Singapore Press Holdings (SPH), to target the island state’s small and medium enterprise market.

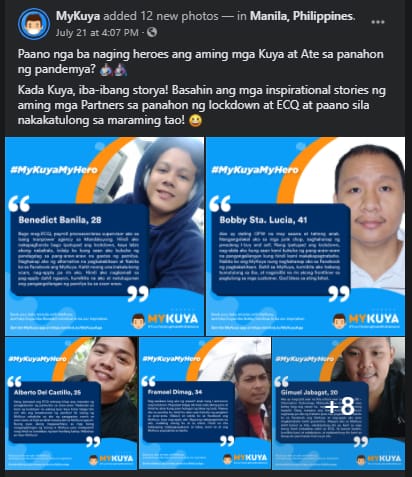

The digital marketing agency provides expert advice and know-how to SMEs to market themselves digitally, and this is the first time the agency has ventured into an overseas market.

The partnership is said to last for three years and will see the Singaporean publishing group reselling the agency’s services.

Executive chairman for Newscorp Australasia Michael Miller said that partnering with like-minded companies is the space that News Xtend has been eyeing to play in.

“We’re now exporting our know-how by partnering with another media company that, like ours, has successfully transitioned to the digital landscape,” said Miller.

He added, “It’s a great acknowledgement that the investment we’ve made to grow and diversify our business is now being deployed by another media business in another region.”

Aside from its publishing business, Singapore Press Holdings houses a number of digital businesses such as marketing communication services, an SaaS platform, and a mobile job portal.

The agency will be providing to SPH’s customers services such as search engine marketing, social media advertising, and video and display advertising.

The agency will also be offering a call tracking service, which will be packaged into simple, outcome-focused solutions, designed to make easy for customers to achieve meaningful business results that they can measure.

SPH’s Deputy CEO Anthony Tan thinks the partnership is well-timed, as the country’s current digital penetration is at almost 90%.

“SPH is excited to provide businesses with an affordable and convenient digital marketing solution to help them achieve their desired results. With this new partnership, we are well-positioned to support SMBs by bridging the gap in the solutions available in our domestic market,” said Tan.

Meanwhile, Emma Fawcett, News Corp Australia’s managing director for commercial product and platforms shared that Singapore has been an obvious choice for the expansion.

The company cites a PwC data which shows that SMEs generate almost half of Singapore’s gross domestic product and accounts for 72% of employment, where much of the sector is family-owned.

“Singapore’s explicit digital agenda places it among the region’s most digital savvy nations, which is something that extends to its small to medium business sector and is highly attractive to a business such as ours,” Fawcett said.

She added, “The fact Singapore has important synergies to Australia in terms of industries and digital habits, language and a highly supportive environment for foreign investment are wonderful extras and, of course, Singapore’s status as a critical commercial hub for the entire region is an added bonus.”

News Xtend’s parent company Newscorp Australia owns a portfolio of both national and regional newspapers, and a number of magazine brands. It is also a majority shareholder of merged entities Foxtel and FOX SPORTS Australia.