Indonesia – Shopping app sessions rose 4% globally during Ramadan 2024, but Indonesia saw an 11% surge, reflecting strong engagement and repeat usage, according to a report by Adjust.

Ramadan drives a surge in shopping as mobile-first consumers seek deals and Eid gifts. The report also highlights a surge in other app categories during Ramadan. In Indonesia and Pakistan, gaming and entertainment app engagement rose by 7% as many users unwind with digital entertainment after iftar, driving increased nighttime activity.

In Indonesia, fasting month routines further boosted mobile reliance, with utility app sessions up 10% for tasks like transportation, bill payments, and productivity. This shift underscores the role of mobile apps in ensuring a seamless and connected Ramadan experience.

To maximise impact during Ramadan, Adjust advises marketers to align their campaigns with these user behaviour trends.

The report finds that user activity peaks after Iftar (48%), post-Taraweeh prayers (38%), and early before fasting (24%). To maximise engagement, brands should time ads, promotions, and push notifications around these high-activity periods. Value-driven offers—such as limited-time discounts, bundle deals, and cashback rewards—can further drive conversions, appealing to price-conscious consumers actively seeking the best deals.

Beyond timing and offers, personalisation plays a key role in user engagement. Adjust highlights the importance of AI-powered recommendations and smart audience segmentation, leveraging browsing behaviour, location, and past purchases to boost conversions. Automated push notifications and in-app messages further enhance the user experience by delivering relevant content at the right moments.

With consumers frequently switching between apps, websites, and social media, a seamless omnichannel experience is essential. A unified strategy across platforms, paired with retargeting on Facebook, YouTube, Instagram, and TikTok, keeps brands top-of-mind and reinforces messaging across touchpoints.

In terms of content strategy, the report notes that videos, live streams, and interactive formats like quizzes and polls drive engagement, while culturally relevant Ramadan themes strengthen user connection. Content around meal prep, fashion, and gifting also serves as key engagement touchpoints, catering to seasonal interests and shopping behaviours.

Moreover, brands can deepen their connection with consumers by emphasising social good and community engagement. Adjust recommends fostering goodwill through charity partnerships, donation-matching programmes, and storytelling that highlights Ramadan traditions, reinforcing brand affinity during this meaningful season.

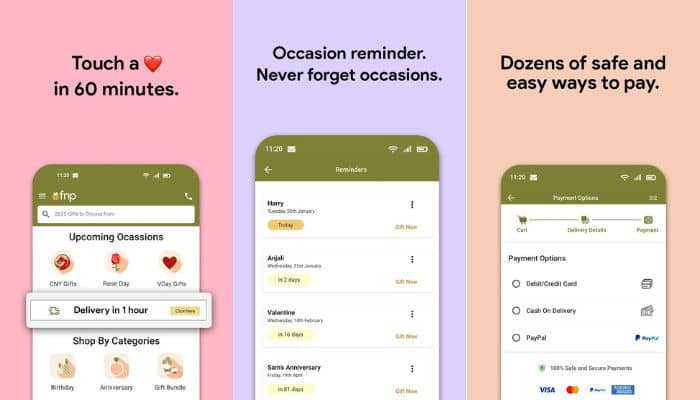

Finally, as the Eid shopping rush approaches, brands should be prepared with fast shipping, exclusive discounts, and fintech solutions that ensure seamless transactions, capturing last-minute demand and maximising sales.

April Tayson, regional vice president for INSEAU at Adjust, said, “Ramadan is a time of meaningful connection, and brands have an opportunity to contribute by delivering value through thoughtful engagement. With Adjust’s powerful measurement and analytics suite, marketers can optimise every step of the user journey, whether for Ramadan campaigns or year-round strategy.”