In today’s global economy, the ability to communicate effectively across cultures has evolved from a competitive edge into a fundamental business necessity. As brands extend their presence across borders, the real challenge lies not just in crafting messages that work internationally – but in making those messages genuinely resonate within each local market.

For marketers, this means moving beyond basic translation to embrace strategic localisation – a practice rooted in cultural intelligence, deep audience insight, and the agility to adapt messaging without losing brand integrity. It’s a delicate balance: maintaining global consistency while responding to regional behaviours, values, and platform preferences.

As consumer expectations shift and digital touchpoints multiply, the brands that win will be those that speak the local language – not just in words, but in meaning. These expectations–and more–are what have been discussed in the recently concluded Global Conversations, Local Impact: Mastering Regional Communication Strategies, held on 17 June 2025.

Leveraging conversation channels to scale customer communication

In the webinar’s keynote presentation from Hugh Haley, Head of Partners for APAC at Sinch, he outlines the dramatic shift in global communication trends, where nowadays, communication towards customers has evolved into two-way, real-time conversations driven largely by the proliferation of mobile devices and social messaging platforms.

In addition, as mobile usage has grown, so has the richness of the messaging experience, with brands moving away from static SMS into dynamic, media-rich formats such as RCS (Rich Communication Services), which allows for verified sender information, branded UI, multimedia sharing, and interactive chatbot experiences.

Hugh also emphasises that the future of customer experience hinges on successfully combining AI with messaging platforms, adding that successful businesses will build systems that enable seamless AI-human collaboration in customer support and engagement.

“For brands to really achieve success, they’re going to need to address both AI and agentic experiences and those conversational channels at scale. Customer experience is where we believe the battle is going to be won and lost. And the businesses that adopt both AI and conversational channels are the ones that will really win in the long term,” he said.

Moreover, he puts focus on how chatbots are becoming the new “front desk” of a brand, acting as always-on concierges for customers. However, he cautioned that deploying a chatbot isn’t a set-it-and-forget-it task – it requires constant training, language and slang adaptation, monitoring for errors or AI hallucinations, and alignment with the brand voice.

“Your chatbot is the new front desk of your brand. It’s not a set-and-forget play – it’s a constant train, iterate, and improve loop. You need to monitor how the bot behaves, make sure it doesn’t hallucinate or go off-script. This is where your brand voice lives now, and you need to treat it with the same care as any customer-facing channel,” he added.

What lies ahead for the future of communication strategies in APAC

Next up on the webinar was a panel discussion featuring industry leaders May Ling Chan, Head of Brand & Marketing Services at CelcomDigi Bhd; Angeline Angeles, Marketing Director at GoTyme Bank; Hugh Haley, Head of Partners for APAC at Sinch; and Alyaa Ramlan, Head of Social at Unifi, as they discussed the future of customer communications in Asia, including the rise of super apps and their profound impact on how brands connect with consumers, and how to delve into the role of AI and automation in enhancing and streamlining customer interactions.

In the discussion, the industry leaders have noted that as super apps continue to dominate how customers interact with brands across Southeast Asia, companies are rethinking how to blend personalisation, platform strategy, and real-time service to meet rising expectations.

For Angeline, the journey always begins with trust.

“At GoTyme, nobody cares about a cashback promo if their salary didn’t go through,” she said. “So we focus on what we call ‘beautiful basics’– that’s a seamless digital onboarding, fraud protection, goal-based savings, and instant transfers. Trust comes before anything else.”

Meanwhile, May Ling emphasised the power of data-driven prediction in building what she calls a “digital concierge” brand experience.

“In today’s world – especially post-pandemic – apps are built to serve customers in their own customised view. We sit on a 20 million customer base, and we know their online behaviours, what they watch, when they browse. Using that data responsibly lets us act like a concierge – serving the right offer at the right time, predicting when something might go wrong and fixing it before the customer even notices,” she said.

She also added that hyper-personalisation has become a strategic advantage for telcos, allowing them to retain relevance even as digital ecosystems become more crowded.

From a social engagement perspective, Alyaa made it clear that social media isn’t being replaced by apps – it’s becoming their strategic partner.

Using their telco’s app as an example, she shared, “Our app handles transactional tasks like bill payments. But when the internet’s down, people don’t go to the app – they run to Twitter. That’s our feedback loop. We take those complaints and feed them into the product team. Then if we need to educate customers – how to reset a router, how to use a feature – we push that from social. It’s one engine. Both parts need to run in sync.”

Alyaa also praised how AI has transformed her social listening operation – from a manual three-person task into a one-person job powered by intelligent tools that spot crises and sentiment trends in real time.

And when it comes to the AI revolution itself, Hugh urged brands to future-proof their customer strategies with conversational platforms.

“We’ve gone from dumb bots that couldn’t understand a basic question to conversational AI that understands 125 languages. If your app goes down, do you still know how to reach your customer? That’s the question. You need to own your first-party data,” he said.

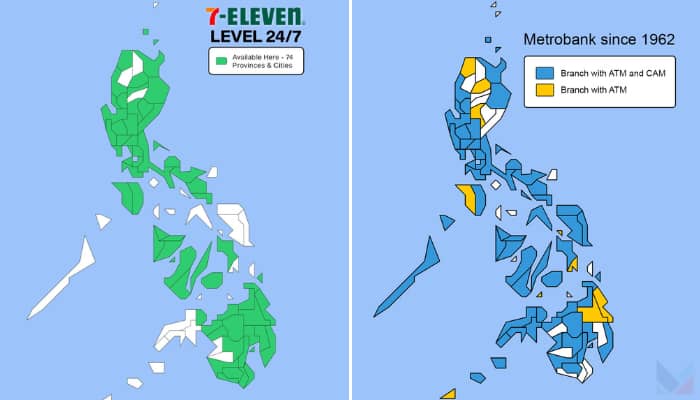

A total of 164 marketers attended the webinar, representing brands such as 2GO Group Inc, AIA, AirAsia MOVE, Alfamart Trading Phils. Inc., AXA Philippines, Bata Group, City Savings Bank, ComfortDelGro Corporation Australia, Cushman and Wakefield, Decathlon Philippines, GetGo Carsharing, Hong Leong Bank Berhad, Malayan Insurance, Metropolitan Bank, PBCOM, Photobook Worldwide, Puregold Price Club, Shopee Malaysia, SSI Group, Tonik Digital Bank, ZALORA, amongst others.

If you missed attending it, you can catch the on-demand access to the webinar, where brands explore strategies to boost customer engagement. Register HERE for free.