Singapore – Singapore-based contactless payment platform EZ-Link has partnered with global payment technology company Mastercard to launch its ‘Pay by Wallet’, a digital wallet product that leverages Mastercard’s ‘Pay by Account’ technology for making contactless and e-commerce payments including recurring payments at Mastercard accepting merchants globally.

The introduction of ‘Pay by Wallet’ aims to empower more consumers across all walks of life to access digital payment capabilities in line with their needs and participate in the digital economy.

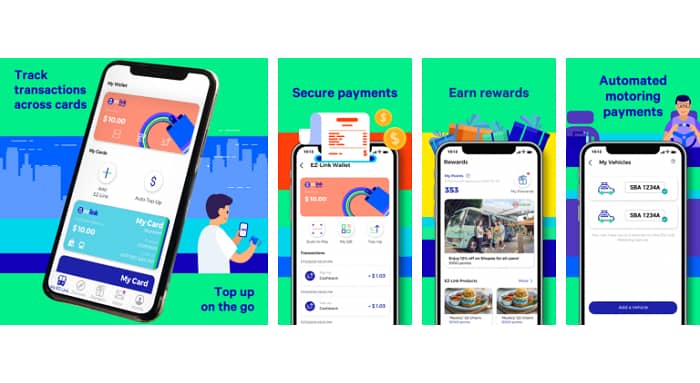

By activating ‘Pay by Wallet’, users can now use their EZ-Link Wallet to make online and in-store contactless payments at over 80 million Mastercard merchants worldwide. This means that they can use ‘Pay by Wallet’ to shop online, as well as manage subscriptions for services like Netflix, Disney+, Spotify, gym membership, and ride-hailing, amongst others. Users will also be able to add ‘Pay by Wallet’ to Google Pay1to make contactless mobile payments for both retail and transit transactions.

Moreover, users can earn EZ-Link Rewards points with every transaction and redeem them for benefits from over 200 merchants on the EZ-Link Rewards platform, which ranges from F&B, retail, and motoring, amongst others. They will also be entitled to exclusive offers across Mastercard’s Priceless Specials, a curated list of offers that cut across key passion pillars of eat, play, shop, and stay.

Nicholas Lee, EZ-Link’s CEO, shared that as consumers’ lifestyles continue to evolve with increasing digitalisation, they want to transform alongside them to serve their everyday needs, and with ‘Pay by Wallet’, they will be able to empower consumers with greater flexibility and convenience when making domestic and cross border payments digitally.

“At EZ-Link, we have built a strong anchor in transportation, and will continue to build on that success by steadily penetrating the digital marketplace to enable more inclusive digital payment services for Singaporeans,” said Lee.

Meanwhile, Deborah Heng, Mastercard’s country manager for Singapore, commented that they are delighted to partner EZ-Link to power the growth of the digital payments ecosystem in Singapore.

“With the value of digital wallet transactions expected to grow, this innovative Pay by Account technology is timely and will allow EZ-Link to expand its reach by offering five million users the ability to transact anywhere and anytime, leveraging Mastercard’s comprehensive global acceptance,” said Heng.

As part of the launch, EZ-Link is offering a sign-up bonus to the first 20,000 users who activate Pay by Wallet on their EZ-Link App. They will receive S$5 credit upon sign-up, and an additional S$5 cashback on their first spend5. This campaign runs until 31 July 2022. During the same period, users who pay with EZ-Link Pay by Wallet will automatically be enrolled in a lucky draw, and stand to win prizes including 2D1N staycation packages at Resorts World Sentosa and Universal Studios.