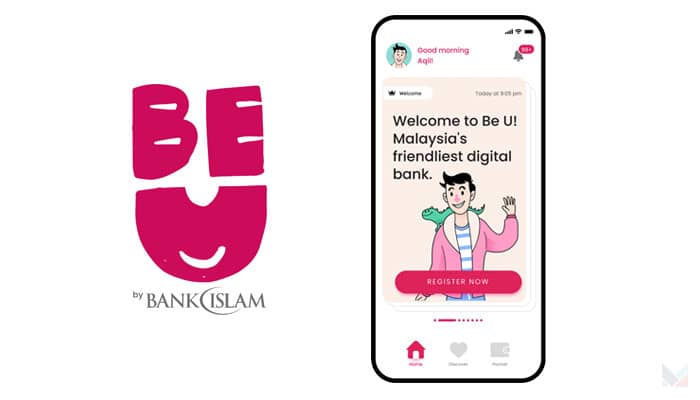

Kuala Lumpur, Malaysia – Islamic bank based in Malaysia, Bank Islam, has officially launched its fully cloud-native digital banking proposition ‘Be U’, a cloud-native solution that is anticipated to be the cornerstone of all upcoming digital banks to be introduced in Malaysia.

The all-new banking app allows users to do their banking transactions seamlessly, without the hassle of visiting a branch, thus broadening financial inclusivity by targeting the digital-native, younger generation. Its engaging and user-friendly interface is intended to help users quickly understand and manage their finances.

In addition, Be U uses Mambu Digital Core as its technology backbone and is housed in Amazon Web Service (AWS) cloud. Having zero legacies allows Be U to meet customers’ needs quickly. By leveraging its cloud-based advantage, Be U users can benefit from the agility of the app and enjoy a curated, user-friendly and personalised banking experience.

Mohd Muazzam Mohamed, group CEO at Bank Islam Malaysia, said that Be U is a gamechanger for Bank Islam and the Islamic banking industry, as it is a product that intends to redesign and catalyse Bank Islam’s future growth by leveraging the rapidly changing fintech landscape and further allowing customers access to an affordable and easy-to-use financial solution.

“Through Be U, Bank Islam is shifting from being product-centric to customer-centric in building products that fulfill customer needs. This effort aligns with our five-year business strategic plan (LEAP25), which aims to become the champion in Shariah-ESG total financial solution with leadership in digital banking and social finance,” he added.

He further shared that having taken a holistic approach to meet customers’ needs, the bank has designed the digital bank proposition to be different and complementary to what is presently available in the market. Be U is targeted at the younger generation, offering a savings account that allows zero balance, fund transfer capabilities, and a Nest feature that helps users save for specific goals.

“There will be frequent new functionalities or offerings on the Bank Islam Be U app over the next 12 months, including term deposit, gig marketplace, debit card, personal financial management, micro-financing, micro takaful and much more. We will replicate the learnings from Be U into the entire organisation, which is the bigger picture we’re looking at. We want to turn Bank Islam into an increasingly agile organisation by adopting new ways of working, attracting talents with new skill sets, using the latest technology, and leveraging data and automation. This will, in turn, enable Bank Islam to serve our customers better,” said Mohamed.

Made available to the public since mid-June this year, Bank Islam targets between 350,000 and 400,000 downloads and users of the Be U app within the first 12 months of its operations. With no charge to open a Be U account through the platform, users can download the Bank Islam Be U app free through Google Play Store and Apple App Store.