Singapore – Standard Chartered Bank and FairPrice Group have recently launched their new digital bank for Singapore, Trust Bank, and WPP creative company Superunion has been tapped to lead its overall branding.

Trust Bank, known as Trust, is a digital bank designed to offer easy-to-use and transparent banking experiences with a launch of products that include a credit card, a savings account, and family insurance. Backed by a unique partnership between Standard Chartered Bank and FairPrice Group, it brings together a leading international bank and a leading national food retailer, with more than 200 years of combined experience serving the everyday communities of Singapore. Superunion was tasked with creating a new inclusive brand, visual identity, and brand experience to reflect the new bank’s role “in the fabric of the nation and the lives of its people.”

Superunion said the new brand is designed as a ‘love letter’ to everyone who calls Singapore home, celebrating the everyday lives and spirit of the people who come together to build a brighter future for the country. The brand is inspired by the idea ‘a digital bank for the everyday us’, and is designed to reflect the approachable and accessible nature of the bank.

According to Superunion, the wordmark in lower case is an expression of trust as the foundation of today’s banking and indicates the bank’s aim to be more in tune with customers through a clear, down-to-earth banking experience.

To develop a unique illustration style for the bank’s communications, the agency worked with typographer Raymond Burger and illustrators Soh Eeshaun and TYC Studios. The added signature icon of the letterform ‘T’ in two blocks is inspired by Singapore’s building architecture – designed using its iconic pastel colours. Created in two core colours, the blue captures the bank’s stability and security, while the purple is a symbol of optimism and a nod to the national flower, Vanda Miss Joaquim.

Scott Lambert, Superunion’s creative director, said, “It’s been a privilege to partner with the Trust Bank team to create a new revolutionary digital bank in Singapore. Banking, as an essential aspect of everyday life, needs to be simple, accessible and easy for the end customer to use. The Trust Bank aims to deliver that experience by demystifying banking and empowering local people. We brought this to life within the brand through collaboration with employees and leaders across the entire business.’

He added, “Superunion wanted to show that Trust Bank is a brand that truly understands what it means to call Singapore home. We are proud of a brand platform that inherently delivers against the needs of Singaporeans through deep insight around what it means to live, work and spend here.”

Meanwhile, Kelvin Tan, CMO of Trust Bank, commented, “Working with Superunion to build the Trust Bank brand was both a strategically and creatively-inspired experience. They took the time to immerse in our consumer insights and corporate ambition – and coupled with their creative expertise, a brand that speaks to the diverse needs of consumers in Singapore was born! Having trust deeply rooted throughout the collaborative journey, from strategy development through to visual identity, means we all had a hand in creating this new brand for all of us in Singapore.”

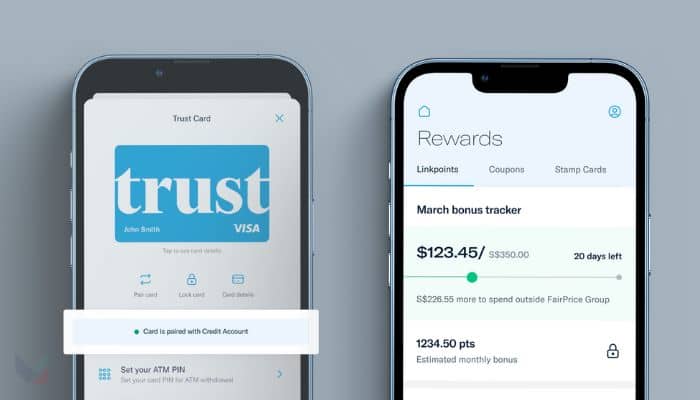

Trust was officially launched on 1 September 2022. The bank brings several market-first innovations to Singapore, including banking only through the app with integrated rewards and spend trackers, as well as the first-to-market numberless credit card, which also combines a credit and debit card, removing the need for users to own multiple cards.

Supporting the launch of Trust is an omnichannel brand campaign by IRIS Worldwide and Havas Media with the tagline ‘The digital bank for the everyday us’, which will be delivered across TV, print, digital, out-of-home and creative in-store activations at FairPrice Group retail stores.