Manila, Philippines – Popular mobile wallet GCash has teamed up with property developer Ayala Land to now allow users to view select properties, inquire and access cashless payments when investing in real estate.

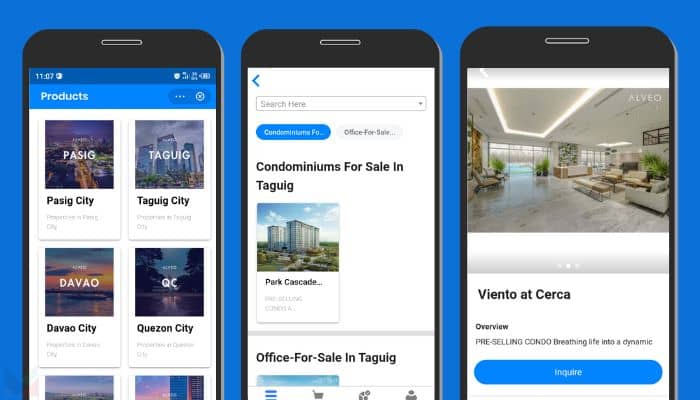

According to a report by ABS-CBN, users can log in to the app’s GLife feature to browse Ayala Land’s property listings and submit an inquiry. Property listings can be viewed by tapping GLife and searching for the ‘real estate’ tab.

Martha Sazon, president and CEO of GCash, said, “With this partnership with Ayala Land, GCash enables potential homeowners and property seekers to conduct virtual unit viewing and, after they make the decision to buy a property, access cashless payment of reservation fees using their e-wallet account.”

Meanwhile, Bobby O. Dy, president and CEO at Ayala Land, commented, “As more and more individuals are turning to the convenience of online shopping, we strongly believe that buying home and real estate properties should not be any different. By launching four of our key brands on GLife, Filipinos can now have a more seamless experience in buying Ayala Land properties.”

The announcement comes after GCash recently announced the opening its new in-app stock trading platform service ‘GStocks’ and a digital wallet for minors ‘GCash Jr’.