Manila, Philippines – Aiming to provide Filipinos with better financial services, Pouch.ph has recently announced a collaboration with One Cooperative Technology Service (OCTS), introducing its first and only CDA-registered technology service cooperative mobile wallet.

Known as CoopPay, the platform intends to provide cooperatives, members, and families with a fast, affordable, and secure means to send and receive peso payments and bitcoin payments using the Lightning Network.

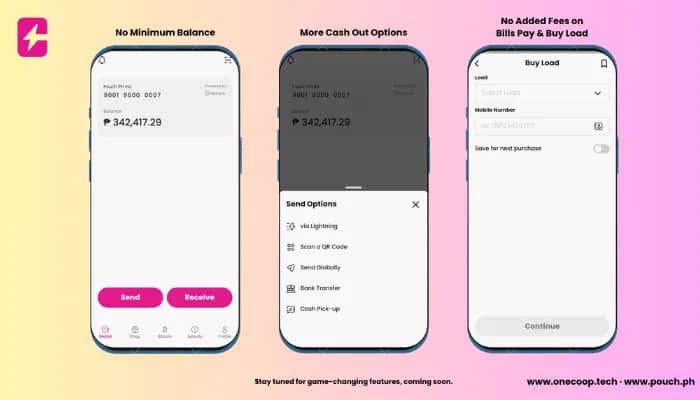

Amongst the primary functions of the app allow users to deposit and withdraw Philippine pesos, make CoopPay to CoopPay transfers, conduct bank/fund transfers in UnionBank, BPI, BDO, Metrobank, GCash, and Maya, among others, and utilise cash pick-up services.

Payments through the application are less expensive since neither Pouch.ph nor the cooperative organisations charge any service fees or markups. The app, for instance, offers a 15-peso minimum fee and no predetermined transfer limits.

In addition, the mobile wallet programme features a shop tab that makes it possible for users to buy loads for all networks, pay for transport services (Beep, Autosweep, Easytrip), and pay bills (Meralco, Maynilad, Converge, SkyCable, and many other billers).

This initiative follows the company’s vision to provide a medium-term best-practice model for cooperatives in the Philippines and the ASEAN region.

Following this endeavour, Fr. Anton CT. Pascua, chairman of the board at OCTS, expressed excitement about the nationwide rollout, stating, “CoopPay is an idea whose time has come! But let us not forget why we are doing this; we are doing this to improve the economic lives of our members and their families.”

Ethan Rose, founder and CEO at Pouch.ph, also shared his insights about the project, stating, “Our priority is to bring financial access, service, and opportunity to all Filipinos, particularly with a strong focus on customer care and global connectivity. Our collaboration with OCTS to launch CoopPay will enable us to bring better financial services to millions of Filipinos.”

Meanwhile, Anna Marin Crisolo, COO at One Coop Tech, said, “It has always been our mission at OCTS to facilitate financial empowerment at the grassroots level. We want to show the way for our brother-and-sister cooperatives in the ASEAN region. After much work and overcoming challenges, we are ready to do that. The CoopPay app, powered by Pouch.ph, is our next step in that direction.”

Since its nationwide rollout in October, they are now set to extend the service to other cooperative groups across the country. CoopPay also made a successful rollout to 100,000 members of the First Community Cooperative (FICCO) since then.