Singapore – Singapore-based CARRO has released its first-ever regional brand film ‘A Car’s Journey in Reverse’, produced by creative agency TBWA\Group Singapore and production houses Applebox Asia, Fuse Adventures in Audio and The Quiet Lab.

Launching across Singapore, Thailand, Indonesia and Malaysia, the campaign aims to elevate the overall awareness of CARRO’s brand, service, and values in a way that’s honest and fun.

Said Katherine Teo, regional head of marketing, for CARRO, said, “This campaign is part of our larger regional market expansion plans, and our goal is to increase people’s confidence in purchasing a used car – importantly, one from CARRO.”

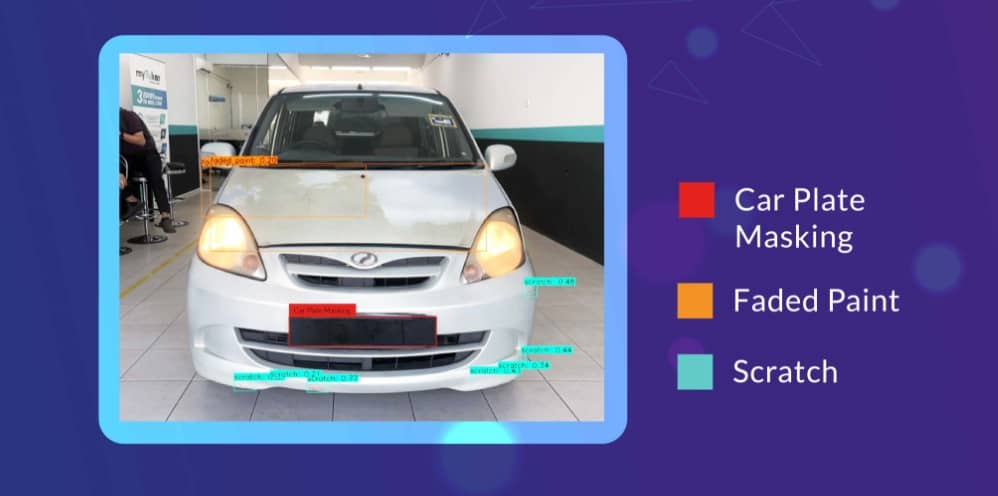

Meanwhile, Simond Chew, creative lead of the brand, commented, “The purpose of this film is to help build CARRO long-term brand vision of trust. At CARRO, we will always be truthful about a car’s history – through our rigorous 160-point inspection and high-quality refurbishment process, we ensure that all CARRO Certified cars sold will be as good as new.”

While used cars have been routinely flagged as the more affordable and sustainable option, there is a lingering perception that there are hidden risks when it comes to buying used cars due to a lack of transparency over their driving and maintenance history.

Robert Nelk, associate creative director of TBWA\Singapore, said the intent of the film is to take a step back, literally, to cleverly showcase the bigger picture that when you buy a used car from CARRO, it comes with quality assurance.

Christopher Hill, film director from AppleBox Asia, said, “By throwing the film into reverse, the story of the car’s history unfolds through the lens of the vehicle’s previous owners — everything from the car’s regular upkeep and maintenance to the unwanted bumps in the road.”

The film includes scenes of potential damage to the interior and exterior of the car, showing that if there are any defects, CARRO finds and fixes them, restoring the car to a condition that’s as good as new.

To capture these damages occurring as authentically as possible, scenes in the film were carefully planned down to the smallest detail, with numerous footage re-shot to mirror realistic everyday situations. For example, the red CARRO was driven into the curb numerous times to trial-and-error for a scratch on the front bumper (that’s not too big and not too small) and was driven over an actual speed bump several times for the perfect milk-shake spill.

To fully achieve the film’s vision, a stunt driver brought to life the experience of travelling back in time by driving in reverse, in real time, while the world moved forward. “This unique approach demonstrated CARRO’s pursuit of perfection, attention to detail and pride in their approach when it comes to going the extra mile for car buyers,” said Mark Peeters, associate creative director of TBWA\Singapore.