Jakarta, Indonesia – Technology group Gojek has announced its investment to technology-based Bank Jago as part of a strategic partnership for Indonesia’s accelerated financial inclusion.

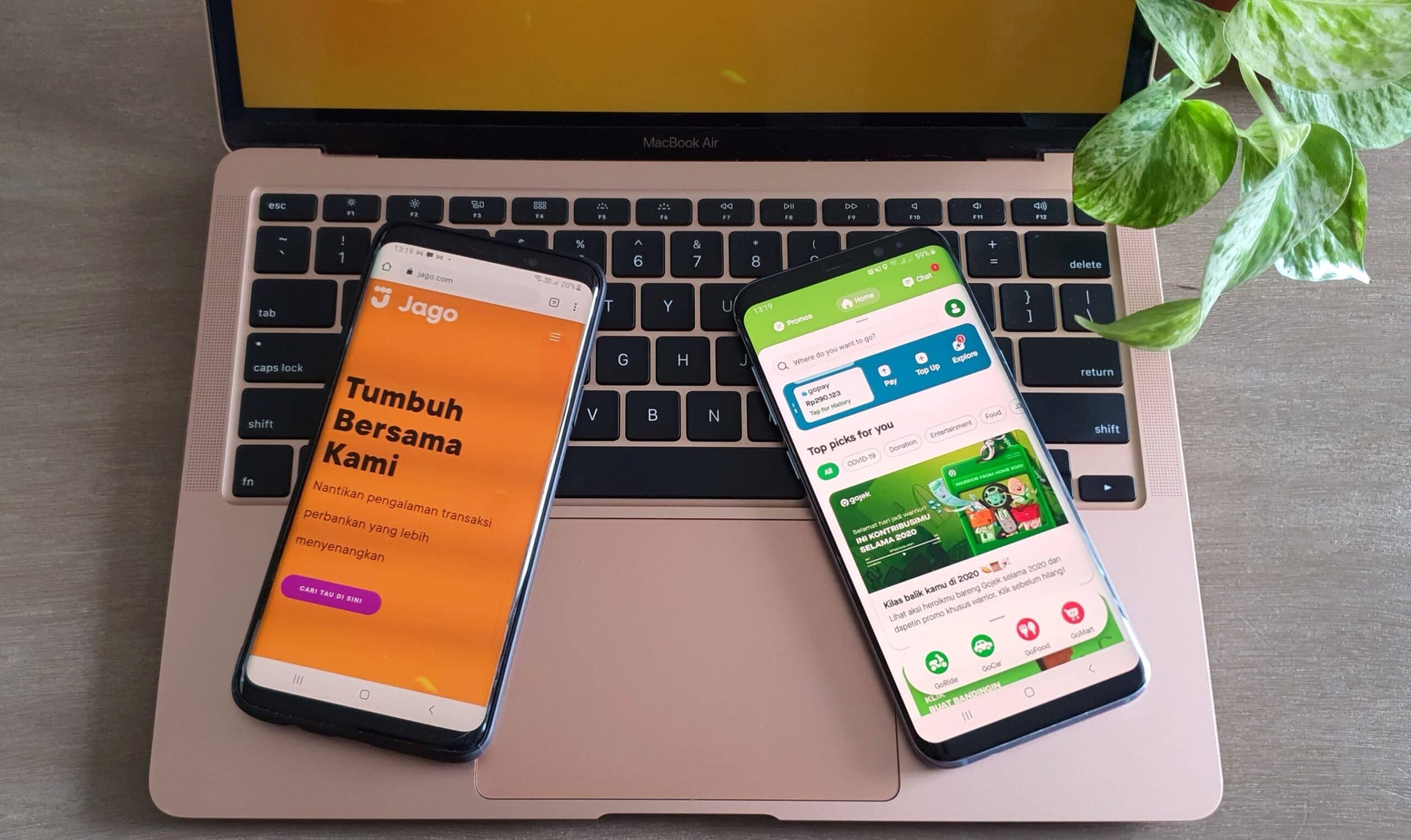

Within the partnership, Gojek and Bank Jago aim to bring digital banking closer to users through Gojek’s payment platform GoPay. Users can now open a Bank Jago account and manage it through the Gojek app. The partnership will also act as a model through which Gojek will go on to partner with other banking institutions to support them in reaching more customers.

For Gojek CEO Andre Soelistyo, the newly-forged partnership is a strategic move to get banks working for the superapp, hence leveraging Gojek’s purpose to be an accessible financial platform for Indonesians.

“Our partnership with Jago marks the latest milestone in our drive to reduce daily friction for users and improve their lives through technology. It is a key part of our strategy and will underpin the growth and sustainability of our business in the long term. Jago’s tech-based banking solutions will supercharge Gojek’s ecosystem offerings and facilitate access to banking services for the mass market, thereby supporting our common vision to accelerate financial inclusion in Indonesia,” Soelistyo stated.

The investment, made through Gojek’s financial and investment arm, would mean that 22% of Bank Jago will be held by Gojek.

On the other hand, Bank Jago’s president director Kharim Siregar, expressed high hopes for the new partnership, as it complements the Bank’s broad expertise to Indonesian financial needs.

“We believe that this strategic collaboration – between a tech-based bank like Bank Jago and a Super App like Gojek – is the first of its kind in Indonesia and Southeast Asia and represents a new way to spur growth in digital economies. As a bank designed with an open API, we will go on to work with multiple digital ecosystems to reach a wider audience and drive our aspiration to enhance the finances of millions of people through digital financial solutions,” said Siregar.