Singapore – Instarem, a cross-border payments platform, has launched a new brand identity, as well as a new mobile application catered to users in Singapore.

The rebrand involves a new logo, redesigned website, as well as the launching of a consumer debit card called ‘Amaze’ for users within the year.

With the new rebrand, Instarem seeks to go beyond just enhancing consumer remittances globally, to move towards being the change-driver for the complexities around global payments – empowering its customers to do more with their money in an intuitive, transparent, and cost-effective manner.

According to Yogesh Sangle, global head of Instarem, Instarem’s rebrand aligns with the new consumer initiatives to be rolled out in Singapore in coming months, as the company moves beyond digital remittances to becoming an all-in-one app for consumers.

“We see the future of Instarem as becoming an essential part of our customers’ everyday lives, offering them the most convenient option for money transfers. Our new identity reflects our belief that money should not be disconnected – it should be simple – and our enhanced offerings bring this belief to life. Our new look better represents who we are today – current, innovative, and global,” Sangle stated.

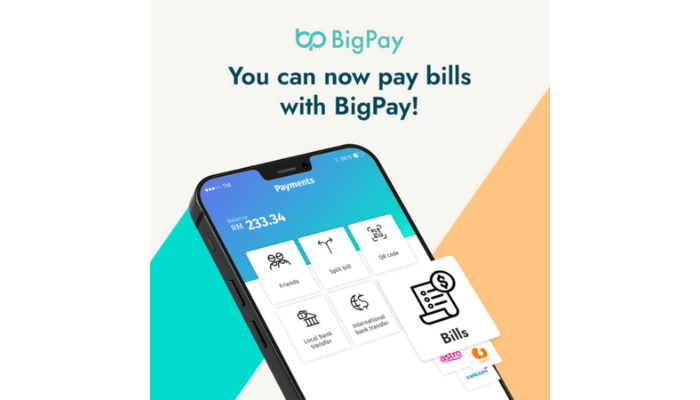

He added, “Our new mobile app provides increased usability for Singapore users that makes it easier for them to navigate and manage their transfers from anywhere in the world. Singapore customers can also expect a new and improved Instarem experience through the launch of a consumer debit card, which allows them to consolidate all their spendings in one.”

Instarem currently operates in six continents and over 100 markets, including markets in APAC such as Australia, Singapore, Hong Kong, Malaysia, and India.