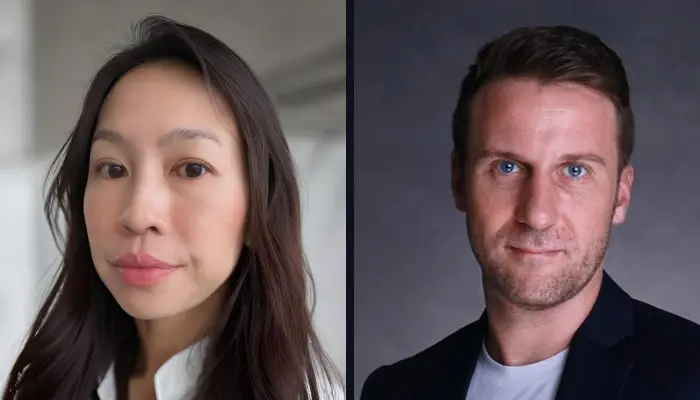

Singapore – MoneyHero Limited (“MoneyHero” or the “Company”), a Southeast Asia-based personal finance and digital insurance aggregation and comparison platform, has announced two significant additions to its senior corporate team. Liru Chan has been appointed as the company’s new group head of marketing, and Francois Picard has been named as MoneyHero’s new group head of operations, effective May 6, 2024.

Chan and Picard will be based in the company’s Singaporean headquarters.

Chan has taken on the role of group head of marketing, where she will be in charge of managing brand development and consumer marketing across MoneyHero’s operational regions and portfolio. Furthermore, she is positioned to make a substantial contribution to the company’s overall sales and customer engagement initiatives.

Chan joins MoneyHero from Google (APAC), where she was responsible for strategy and growth for owned direct acquisition and sales enablement since 2021 as head of growth (owned user experience). Prior to working at Google, Chan had senior positions at PayPal, Edelman, and Visa, where she was head of marketing (Singapore).

Picard’s new role as Group Head of Operations includes developing and improving the company’s operations across the organisation to support MoneyHero’s upcoming phase of growth as a publicly traded entity.

Picard comes to MoneyHero from ShopBack, where he was the vice president of operations since 2017. In this role, Picard oversaw the advancement of ShopBack’s operational frameworks and customer service operations, leading a team of over 130 people and developing the platform in accordance with a growth strategy across 11 markets. Picard held leadership positions at Honestbee and Schneider Electric before joining ShopBack.

Speaking about the appointments, Rohith Murthy, chief executive officer of MoneyHero, said, “On behalf of everyone at MoneyHero, I want to welcome Liru and Francois to the company. To build and support a world-class organisation, you need to attract and hire the best talent. The addition of Liru and Francois is reflective of MoneyHero’s consistent ability to do this, which is a critical component of our success and further differentiates us from our peers. With Liru spearheading our marketing strategies and Francois optimising our operations, we have strengthened two key departments with seasoned executives who will enable us to execute on our aggressive growth plans and drive shareholder value more effectively.”

Meanwhile, Chan, group head of marketing with MoneyHero, expressed, “I am thrilled to join MoneyHero at such an exciting time in the company’s history, as well as to join such an incredible team of driven, like-minded individuals. I want to thank Rohith, his leadership team, and the company’s Board of Directors for this fantastic opportunity. I am proud to represent MoneyHero’s mission to empower consumers across Greater Southeast Asia to take better control of their personal finance decisions, and I look forward to helping take this purpose-driven business to the next level.”

Speaking about his appointment, Picard stated, “It is an honour and privilege to serve as MoneyHero’s new Group Head of Operations. Rohith and his team have built an impressive organisation with a proven business model, strong growth drivers, and an impeccable reputation in the marketplace. This curated platform will play a major role in shaping the future of the digital economy in Greater Southeast Asia, and I am excited to be a valuable part of this journey.”