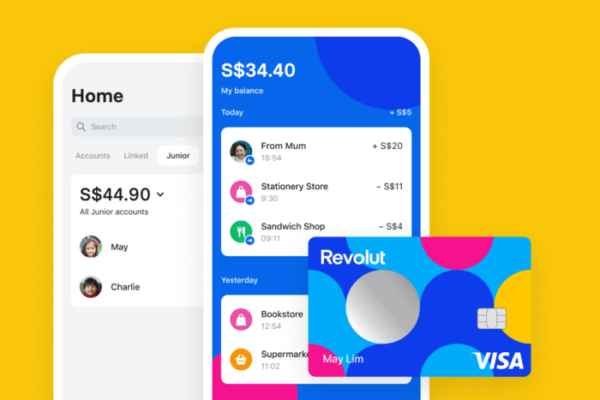

Singapore – Fintech superapp Revolut in Singapore has launched ‘Revolut Junior’ feature, or simply ‘Junior’, to customers in Singapore, which allows parents to create an account for their kids aged 7-17 years old.

Revolut Junior is an account, card, and app that parents can control from their own app. Since Junior was launched in the US, UK, Australia, and wider Europe last year, approximately 10,000 Junior accounts are being created each week, according to Revolut.

Through this new feature, parents can send money to their kid’s Junior account, and track their spending through spending alerts for their kids online and physical in-store payments. Freezing and unfreezing their kids’ card is also doable on the account to secure their account in the event of card loss.

Pam Chuang, Revolut Singapore’s head of growth, stated that 7 is the perfect age for kids to learn how to manage their money.

“In Revolut Junior, parents will find the perfect platform to talk about topics such as goal-setting, budgeting, and responsible spending,” she said.

Meanwhile, Kunal Chatterjee, country manager for Visa in Singapore and Brunei, which has partnered with the fintech for the Junior card, said that being equipped with financial literacy skills will empower children and teenagers to manage their finances better when they enter the workforce in the future and learn how to use digital payments wisely.

“Digital technology usage is prevalent among young children and teens who are extremely technology savvy. At Visa, we believe the importance in educating youths on money management skills and digital payments usage starting from a young age and parental guidance is crucial. That is why we are extremely excited to partner with Revolut to launch the Revolut Junior account, which enables parents to transfer money to their children’s accounts seamlessly while having visibility of how they are spending online, and in stores,” said Chatterjee.

Creating a Junior account is free. Standard customers can create 1 Junior account, while Premium customers can create 2, and Metal customers, 5.

Premium and Metal customers will also enjoy additional features such as ‘Co-Parent’, where 2 adults can send money to and help manage the Junior account, and ‘Tasks’, where parents can reward their children for completing chores. Other features include ‘Weekly Allowance’, where pocket money is automatically added to the Junior account, and a feature called ‘Goals’, where children can save up their spare change to help with a future purchase or target.