Manila, Philippines – Mitsubishi Corporation (MC) has announced that alongside Ayala Corporation (AC), and AC Ventures Holding Corp (ACV), they have reached an agreement on MC’s investment in ACV subject to the execution of definitive transaction documents and the satisfaction of customary closing conditions.

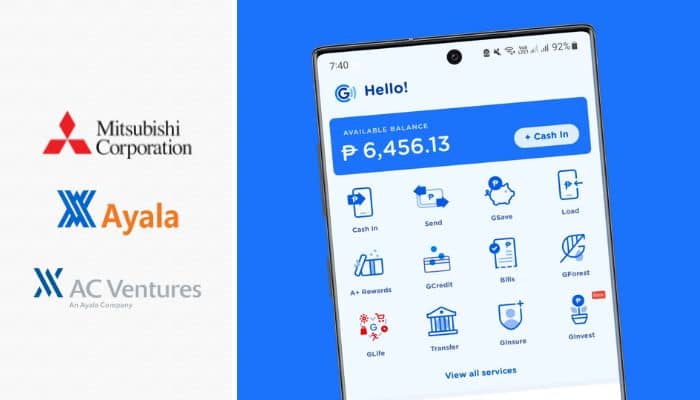

AC is a major conglomerate in the Philippines and ACV currently holds an about 13% stake in Mynt, the parent company of GCash. Under the terms of the agreement, MC shall acquire a 50% stake in ACV and pursue future investment opportunities.

In addition, MC and AC are going to sign a memorandum of understanding (MoU) on a comprehensive collaboration in the Philippines. The MoU covers additional business developments aimed at stimulating the country’s economic growth.

MC aims to create a prosperous society and a “Smart-Life” ecosystem in the form of improved lifestyle for consumers by launching multiple attractive businesses that address social issues and consumer needs in each region and country, and organically connecting them. These ecosystem addresses both challenges faced by social issues and consumer needs, and sustainable growth of our business portfolio.

Data notes that around 80% of the country’s citizens have tried using the GCash mobile wallet, which is Mynt’s core business. With a vision to accelerate financial inclusion in the Philippines, the product has by far the largest mobile-wallet customer base in the Philippines and has grown into an indispensable service infrastructure, relied on by millions for daily payments, transfers and other financial transactions.

In addition to its digital payments and transfers, Mynt, through its other subsidiaries, also provides access to loan services using non-traditional ways to assign customer credit scores to enable access to fair lending. It has also expanded its financial services offerings to provide users access to savings, insurance, and investment products.

Furthermore, it has built the largest network of online and offline merchants including social sellers with over 6 million partners while hosting over 1,000 merchant partners in its app, via GLife.

With this recent partnership, both MC and AC are committed to boosting Mynt’s corporate value and leveraging other joint initiatives to create new businesses in the Philippines and contribute to its economic development. Those efforts will include continuous business development and cross-sales in C2B area like retail and healthcare, and multifaceted collaborations in mobility, renewable energy, carbon management and elsewhere.

Lastly, with the Mitsubishi UFJ Financial Group (MUFG) having also announced its investment in Mynt this past August, MC and AC shall work with MUFG as fellow shareholders to aid the company’s future growth and development.