Manila, Philippines – Brand valuation consultancy Brand Finance has recently released its rankings of valuable brands in the ASEAN region–with fast food chains Mang Inasal and Jollibee, as well as the Bank of the Philippine Islands (BPI) seeing significant growth in their respective markets.

Mang Inasal–whose brand value shot up 201% to US$374m emerges as this year’s fastest-growing brand ASEAN. The brand has moved up by 136 spots to feature as the 146th most valuable brand in the region this year

Meanwhile, Mang Inasal’s sister brand, Jollibee (brand value up 51% to US$2.3b), went up 19 ranks this year to become the 23rd most valuable ASEAN brand.

Climbing up nine spots this year, Bank of the Philippine Islands (brand value up 22% to US$1.5b) ranks as ASEAN’s 45th most valuable brand. This growth is driven by its higher scores in the in ‘familiarity’, ‘consideration,’ and ‘reputation’ metrics, according to market research data.

Within the region’s telecoms sector, Globe Telecom (brand value down 4% to US$1.9b), is the fifth strongest telecoms brand ranked for the year. With a Brand Strength Index (BSI) score of 85.4 of 100, it is also the only Philippines brand among ASEAN’s top 10 telecoms brand.

Other notable highlights for Filipino brands include:

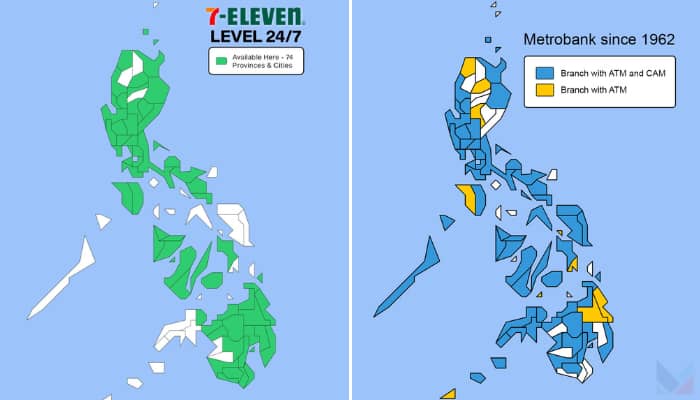

- Metrobank (brand value up 5% to US$1.2b) dropped two ranks to 61st in the ASEAN rankings this year.

- Petron (brand value up 20% to US$828m) is the 83rd most valuable brand in the region, up four ranks compared to 2023.

- Cebu Pacific (brand value up 7% to US$208m) advanced nine ranks to 219th in the region, in addition to being the ninth brand among ASEAN airlines brands.

- Bear Brand (brand value down 2% to US$523m) ranks as the 24th strongest brand in ASEAN, with an AAA brand strength rating and a BSI score of 86 of 100.

- Puregold (brand value up 17% to US$731m) secured the 92nd spot as ASEAN’s most valuable brands of 2024.

- Ayala Land’s (brand value up 54% to US$451m) significant growth in brand value positioned the brand as the 132nd most valuable brand in the region.

- Union Bank of the Philippines (brand value up 22% to US$679m) ranks as the 94th most valuable brand in the region. It is also ranked as the 29th banking brand in ASEAN.

Alex Haigh, managing director of Brand Finance for Asia-Pacific, said, “As the impact of strategic alignment and shared resources in building consumer loyalty and driving sustained growth, iconic brands like, Mang Inasal, Jollibee and Bank of the Phillippine Islands are growing and excelling within their sectors. The collective strength of these brands reflects ASEAN’s unique ability to adapt and thrive, with each sector’s progress amplifying the region’s overall resilience and forward momentum.”