Kuala Lumpur, Malaysia – New report from integrated car e-commerce platform Carsome showed a significant change in private car ownership and the aspect of buying and selling of cars among consumers in Malaysia, Indonesia and Thailand despite COVID-19.

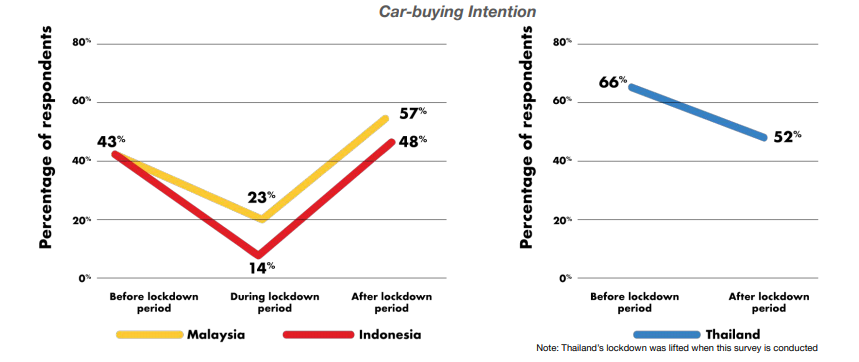

Malaysian and Indonesia consumers have shown a greater interest in buying cars after the pandemic lockdowns, with up to 32% and 12% of consumers respectively showing interest compared to pre-lockdown behavior.

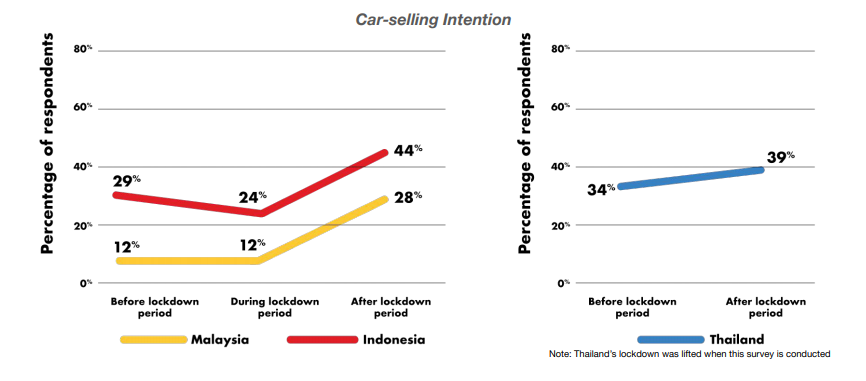

Meanwhile, all three markets saw an increase in consumers wanting to sell their cars, with Malaysia registering a 133% spike of consumers, followed by Indonesians (up 52%) and Thais (up 15%).

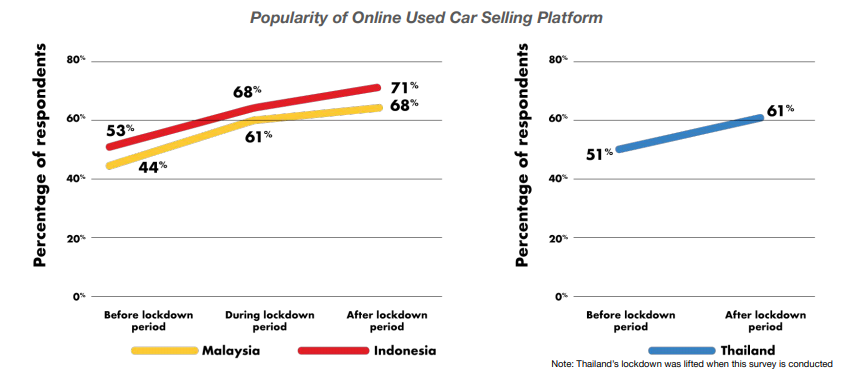

As more and more consumers are selling their old cars due to getting more cash on hand, the usage of car selling platforms, including Carsome, also became popular 55% among Malaysian respondents, 34% among Indonesian respondents and 19% among Thai respondents.

The increase of consumers selling their cars all have primary reasons in doing so due to financial constraints brought by unstable income and lack of budget. Other reasons include selling the much older car in favor of an existing usable car in their property, savings for future circumstances, and uncertainty of the economy after the pandemic woes.

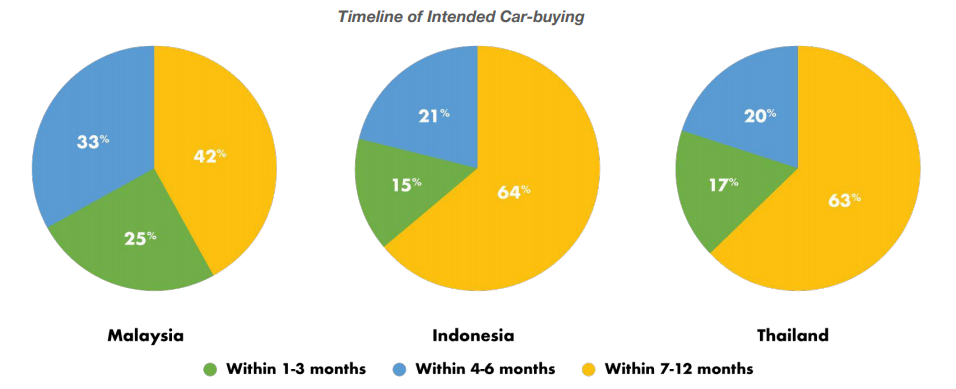

On average, most Malaysian respondents (58%) plan to buy a car in a span of 1-6 months, while Indonesians (64%) and Thais (63%) plan to buy a car in a span of 7-12 months. Those that buy a car in a shorter time span reason out that a car is urgent to carry on daily duties.

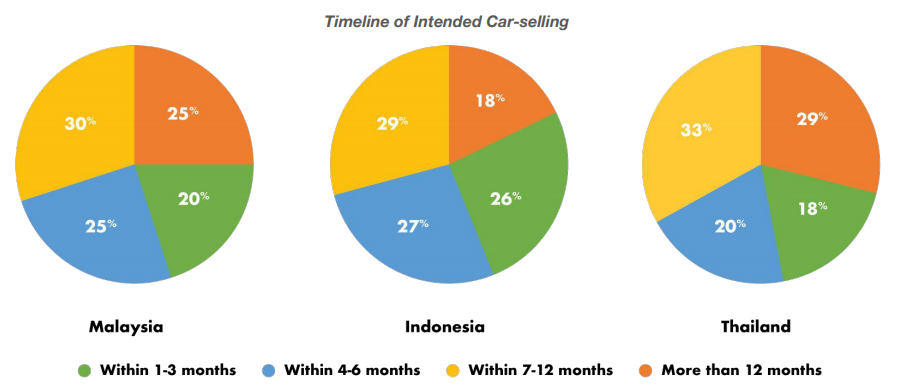

In terms of selling their cars, all the three markets shared an equal view of selling their cars in a span of 12 months, adding up the reason for replacing the car and optimism for the economy post-pandemic on reasons why to sell the car, aside from extra finances. In addition, all markets have shared the same perception that car dealers and car inspection centers are vital in selling cars to reduce contact of COVID-19 (Malaysians, 83%; Indonesians, 92%; Thai, 94%)

More than 50% of Malaysian and Indonesian respondents have lessened their car usage, while Thais have maintained the level of car usage pre-pandemic and post-pandemic.

“The COVID-19 pandemic has changed the way Southeast Asians think of car ownership and mobility. The need to balance socially distancing and financial stability is leading many to a conclusion that the idea of car ownership is valuable to them during the pandemic. The car industry will continue to thrive as more Southeast Asians plan their car buying and selling within one to six months, creating a significant flow of car sales in the industry,” Carsome said in a statement.

Carsome conducted the survey in October 2020 among 1,000 Malaysian consumers, 1,005 Indonesian consumers and 1,055 Thai consumers. The survey was carried out through online panels sourced by research agencies.