Manila, Philippines – Local fiat and crypto wallet services provider Coins.ph has raised US$30m in their latest series C funding to accelerate investment in its Web3 ecosystem, as well as expand its presence in Southeast Asia.

In addition, the additional funding will support the company by reinforcing the platform’s crypto-native credentials and adding new products and services. Current growth plans include adding more cryptocurrency tokens, upgrading and relaunching the Coins.Pro exchange, offering additional crypto-focused merchant and payment services, supporting GameFi and guild management products, and entering new geographies.

For Wei Zhou, CEO of Coins.ph, the new funding is a significant milestone for the platform, and will allow them to accelerate and scale faster, bringing them one step closer to achieving their vision of being the go-to platform for all crypto, Web3, and P2E gaming in Southeast Asia.

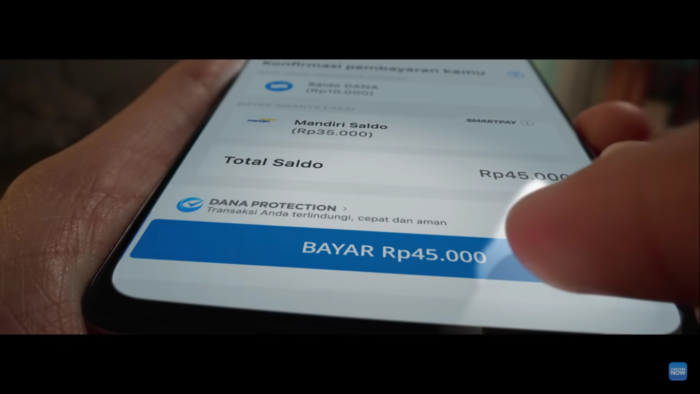

He also added that as the Philippines continues to witness the mass adoption of cryptocurrencies, there is a real need for a secure, regulated, and user-friendly product in the market. Zhou also noted that they are solving that problem by delivering crypto and payment services that allow their customers to access, invest, trade, and spend their crypto assets seamlessly as a part of their daily lifestyles.

“We enable our users, even those without bank accounts, to easily access a wide range of financial services directly from their mobile phones. Our mission is to increase financial inclusion across Southeast Asia’s largely unbanked population of 650 million through our highly trusted brand and long track record of operating in full compliance with regulations. We see a massive opportunity to capture new users as engagement with Web3 surges in the Philippines and beyond. We will continue to build upon our leading market share and acquire new customers with a product that connects digital-first users with real-world goods and services,” he stated.

Coins.ph had been previously bought out by Zhou, who previously served as the chief financial officer at Binance, alongside Joffre Capital. Through the buyout, Zhou has been appointed as Coins.ph’s new CEO, as well as serving as CEO of the platform’s holding company that also operates Thailand’s blockchain-enabled platform, Coins.co.th.